Payroll Software for Business: Efficiently managing employee compensation is crucial for any business, regardless of size. The right payroll software can significantly reduce administrative burdens, minimize errors, and ultimately save time and money. From calculating wages and deductions to generating reports and ensuring compliance, these tools offer a streamlined approach to payroll management, freeing up valuable resources for other essential business functions.

This exploration will delve into the benefits and considerations involved in selecting and implementing the ideal payroll solution for your specific needs.

The market offers a wide variety of payroll software options, ranging from simple, affordable solutions for small businesses to sophisticated, feature-rich systems designed for large enterprises. Factors such as the number of employees, payroll frequency, required integrations with other business systems, and budget constraints all play a critical role in determining the most suitable choice. Understanding these factors is key to making an informed decision that optimizes payroll efficiency and minimizes potential risks.

Running a successful business involves juggling numerous responsibilities, and payroll processing often ranks high among the most time-consuming and complex. Manual payroll calculations are prone to errors, leading to potential legal issues and strained employee relations. Fortunately, payroll software offers a robust solution, automating tedious tasks and improving accuracy. This comprehensive guide explores the benefits, features, and considerations of implementing payroll software for your business, regardless of size.

Understanding the Benefits of Payroll Software

Investing in payroll software offers numerous advantages that extend beyond simply automating calculations. The benefits can be categorized into efficiency gains, accuracy improvements, compliance adherence, and cost savings.

Increased Efficiency and Time Savings

- Automation of repetitive tasks: Payroll software automates time-consuming processes like calculating gross pay, deductions, and net pay, freeing up valuable employee time for more strategic initiatives.

- Reduced manual data entry: Minimizes the risk of human error associated with manual data entry, leading to faster processing times and improved accuracy.

- Streamlined workflows: Integrates seamlessly with other business systems, such as HR and accounting software, creating a unified and efficient workflow.

- Faster pay cycles: Enables quicker and more efficient payroll processing, ensuring employees receive their payments on time.

Enhanced Accuracy and Reduced Errors

- Minimized calculation errors: Automated calculations significantly reduce the likelihood of human error in payroll processing.

- Improved data validation: Many payroll software solutions include data validation features that help identify and correct inconsistencies before payroll is processed.

- Real-time reporting: Provides accurate and up-to-date payroll reports, allowing businesses to monitor payroll expenses and identify potential issues promptly.

Ensuring Compliance and Avoiding Penalties

- Tax compliance: Payroll software often includes features that ensure compliance with federal, state, and local tax regulations, reducing the risk of penalties and fines.

- Labor law compliance: Helps businesses adhere to various labor laws, including minimum wage, overtime pay, and other employment regulations.

- Automatic updates: Many payroll software providers automatically update their software to reflect changes in tax laws and regulations, ensuring ongoing compliance.

Cost Savings and Return on Investment (ROI)

- Reduced labor costs: Automating payroll processing frees up valuable employee time, reducing the overall labor costs associated with payroll management.

- Lower administrative expenses: Minimizes the costs associated with manual payroll processing, such as printing, postage, and manual data entry.

- Improved efficiency leading to increased profitability: By streamlining payroll processes, businesses can focus on core operations, leading to increased productivity and profitability.

Choosing the Right Payroll Software for Your Business

Selecting the appropriate payroll software depends on several factors, including business size, industry, budget, and specific needs. Consider these key aspects:

Scalability and Flexibility

Choose software that can adapt to your business’s growth. Consider features that allow for easy scaling as your employee count increases or your business expands into new locations.

Integration Capabilities, Payroll software for business

Look for software that integrates seamlessly with your existing accounting, HR, and other business systems. This integration streamlines workflows and minimizes data duplication.

User-Friendliness and Ease of Use

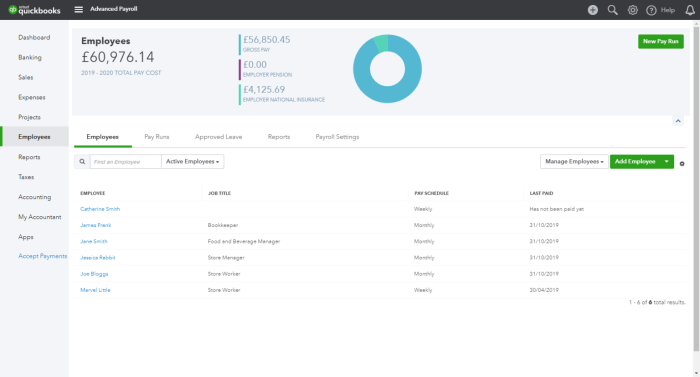

The software should be intuitive and easy to use, even for employees with limited technical expertise. Look for a user-friendly interface and comprehensive training resources.

Source: appypie.com

Security and Data Protection

Payroll data is highly sensitive, so choose software that prioritizes data security and privacy. Look for features like encryption, access controls, and regular security updates.

Reporting and Analytics

Robust reporting and analytics capabilities are crucial for monitoring payroll expenses, identifying trends, and making informed business decisions. Consider the types of reports available and their customization options.

Customer Support and Training

Reliable customer support is essential, especially when dealing with complex payroll issues. Choose a provider that offers comprehensive customer support and training resources.

Pricing and Cost Considerations

Payroll software comes with various pricing models, including subscription-based fees, per-employee fees, or a combination of both. Carefully evaluate the pricing structure and ensure it aligns with your budget.

Key Features to Look for in Payroll Software: Payroll Software For Business

- Employee Self-Service Portal: Allows employees to access their pay stubs, W-2s, and other payroll information online.

- Direct Deposit: Enables automatic direct deposit of employee paychecks, reducing processing time and administrative costs.

- Tax Calculation and Filing: Automates tax calculations and filing, ensuring compliance with all relevant tax regulations.

- Time and Attendance Tracking: Integrates with time and attendance systems to accurately track employee hours and calculate payroll.

- Benefits Administration: Manages employee benefits, including health insurance, retirement plans, and other benefits.

- Reporting and Analytics Dashboard: Provides comprehensive reports and analytics on payroll expenses, trends, and other key metrics.

- Mobile Accessibility: Allows access to payroll information and functionalities from mobile devices.

Frequently Asked Questions (FAQ)

- Q: What is the cost of payroll software? A: The cost varies depending on the provider, features, and number of employees. Some providers offer tiered pricing based on the number of employees, while others charge a flat monthly fee.

- Q: Is payroll software secure? A: Reputable payroll software providers prioritize data security and employ various measures to protect sensitive employee information, including encryption and access controls.

- Q: How long does it take to implement payroll software? A: Implementation time varies depending on the complexity of the software and the size of the business. It can range from a few days to several weeks.

- Q: Can payroll software integrate with my existing accounting software? A: Many payroll software solutions integrate with popular accounting software packages, streamlining workflows and reducing data duplication.

- Q: What kind of training is provided with payroll software? A: Most providers offer comprehensive training resources, including online tutorials, documentation, and customer support.

Conclusion

Implementing payroll software is a strategic decision that offers significant benefits for businesses of all sizes. By automating tedious tasks, improving accuracy, ensuring compliance, and reducing costs, payroll software empowers businesses to focus on core operations and drive growth. Choosing the right software requires careful consideration of your specific needs and business requirements. Take the time to research different options, compare features, and select a solution that aligns with your long-term goals.

References

While specific product names are avoided to remain unbiased, research reputable sources like the following for further information on payroll software and best practices:

- Internal Revenue Service (IRS)

-For tax regulations and compliance information. - U.S. Department of Labor

-For labor laws and employment regulations. - Software review sites like Capterra and G2

-For independent reviews and comparisons of payroll software.

Call to Action

Ready to streamline your payroll process and unlock significant efficiency gains? Explore the various payroll software options available and choose the one that best suits your business needs. Start your free trial today and experience the difference!

Implementing the right payroll software can transform how a business manages its compensation processes. By automating tasks, minimizing errors, and ensuring compliance, businesses can achieve significant improvements in efficiency and accuracy. Careful consideration of individual business needs, including employee count, budget, and desired features, is paramount in selecting the optimal solution. Ultimately, investing in the right payroll software translates to a more streamlined, efficient, and cost-effective payroll operation, allowing businesses to focus on growth and other core objectives.

FAQ Resource

What are the common features of payroll software?

Common features include employee data management, tax calculation and filing, direct deposit processing, timesheet management, report generation, and compliance updates.

How much does payroll software typically cost?

Pricing varies widely depending on the features, number of employees, and provider. Options range from free (often with limited features) to several hundred dollars per month for more comprehensive solutions.

Is payroll software secure?

Source: connecteam.com

Reputable payroll software providers prioritize data security with measures like encryption and secure data centers. However, it’s essential to research a provider’s security protocols before committing.

Can payroll software integrate with other business systems?

Many payroll software options offer integration capabilities with accounting software, HR systems, and time and attendance tracking systems, streamlining data flow and reducing manual data entry.