Paycheck stub generator software has revolutionized payroll processing, offering businesses and individuals a convenient and efficient way to create accurate and compliant pay stubs. These programs automate a traditionally time-consuming task, eliminating manual data entry and reducing the risk of errors. From small businesses to large corporations, the benefits of automated stub generation are undeniable, leading to significant time and cost savings.

This efficiency allows payroll staff to focus on other critical aspects of their roles.

The software typically includes features such as customizable templates, the ability to import employee data from existing systems, and secure storage of sensitive payroll information. Many programs also offer integration with other business applications, streamlining the entire payroll process further. The ease of use and readily available support make these programs accessible to users of all technical skill levels.

In today’s fast-paced business environment, efficiency is paramount. Payroll processing, a crucial yet often time-consuming task, can be significantly streamlined with the help of paycheck stub generator software. This comprehensive guide delves into the intricacies of these tools, exploring their benefits, features, and considerations for choosing the right solution for your business needs. We’ll cover everything from basic functionalities to advanced features, ensuring you have a clear understanding of how these tools can optimize your payroll management.

Understanding Paycheck Stub Generator Software: More Than Just a Stub

Paycheck stub generator software is more than just a tool for creating pay stubs; it’s a comprehensive solution designed to simplify various aspects of payroll administration. These applications automate the process of generating accurate and compliant pay stubs, eliminating manual calculations and reducing the risk of errors. This automation frees up valuable time and resources, allowing your team to focus on other critical business functions.

Beyond stub generation, many advanced programs offer features like employee self-service portals, direct deposit integration, and tax reporting capabilities.

Key Features of Effective Paycheck Stub Generator Software:

- Automated Calculations: Accurate calculation of gross pay, net pay, deductions (taxes, insurance, 401k contributions, etc.), and other relevant figures.

- Customizable Templates: Ability to create professional-looking pay stubs with your company logo and branding.

- Data Import/Export: Seamless integration with existing payroll systems and accounting software through CSV, Excel, or other formats. This simplifies data transfer and reduces manual data entry.

- Employee Self-Service Portals: Allow employees to access their pay stubs online, reducing the need for paper distribution and enhancing transparency.

- Compliance Features: Ensures adherence to federal, state, and local tax regulations, minimizing the risk of penalties.

- Direct Deposit Integration: Streamlines the payment process by directly depositing employee wages into their bank accounts.

- Reporting and Analytics: Provides comprehensive reports on payroll expenses, deductions, and other key metrics for better financial management.

- Security Features: Robust security measures to protect sensitive employee data, such as encryption and access controls.

- Multi-State Payroll Support: Handles payroll calculations for employees in multiple states, considering varying tax laws and regulations.

- Integration with HR Software: Seamless integration with existing HR systems for a unified employee management solution. This streamlines data flow and minimizes data entry errors.

Benefits of Using Paycheck Stub Generator Software

Implementing paycheck stub generator software offers numerous benefits, significantly impacting efficiency and accuracy in payroll management. These benefits extend beyond simple stub creation, encompassing broader aspects of payroll and HR administration.

Improved Efficiency and Productivity:, Paycheck stub generator software

Automation drastically reduces the time spent on manual calculations and data entry. This frees up valuable time for your HR and payroll teams to focus on strategic initiatives rather than administrative tasks. The reduction in manual effort also minimizes the risk of human error, leading to more accurate payroll processing.

Reduced Errors and Increased Accuracy:

Manual payroll calculations are prone to errors. Software solutions eliminate this risk by automating calculations, ensuring accuracy and compliance. This minimizes the potential for disputes and costly corrections.

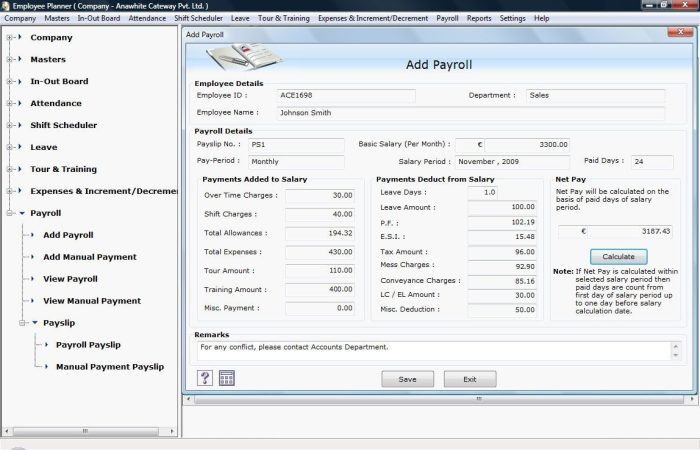

Source: softdeluxe.com

Enhanced Employee Satisfaction:

Employee self-service portals provide employees with easy access to their pay stubs and other payroll information. This transparency fosters trust and improves employee satisfaction.

Cost Savings:

While there’s an initial investment in software, the long-term cost savings from reduced labor costs, fewer errors, and improved efficiency often outweigh the initial expense. The time saved translates to direct cost savings for your business.

Improved Compliance:

Paycheck stub generator software often includes features to ensure compliance with federal, state, and local tax regulations. This helps mitigate the risk of penalties and legal issues.

Choosing the Right Paycheck Stub Generator Software

Selecting the appropriate software depends on your specific business needs and budget. Consider the following factors when making your decision:

Factors to Consider When Selecting Software:

- Scalability: Choose software that can adapt to your growing business needs. Consider future growth and ensure the software can handle increasing numbers of employees.

- Integration Capabilities: Check for compatibility with your existing accounting and HR software to ensure seamless data flow.

- Features: Identify the essential features for your business. Prioritize features that address your specific pain points and enhance efficiency.

- Cost: Compare pricing models (subscription-based, one-time purchase) and factor in ongoing maintenance costs.

- Customer Support: Ensure the software provider offers reliable customer support to address any issues or questions promptly.

- Security: Prioritize software with robust security features to protect sensitive employee data.

- User-Friendliness: Select software with an intuitive interface that is easy for your team to learn and use.

Frequently Asked Questions (FAQs)

- Q: Is paycheck stub generator software secure? A: Reputable software providers prioritize data security with encryption and access controls to protect sensitive employee information. Always check the provider’s security policies and certifications.

- Q: Can I integrate this software with my existing payroll system? A: Many paycheck stub generator solutions offer integration capabilities with various payroll and accounting software through APIs or data import/export functionalities. Check the software’s compatibility with your existing systems.

- Q: What if I have employees in multiple states? A: Choose software that supports multi-state payroll to ensure accurate tax calculations and compliance with varying state regulations.

- Q: How much does paycheck stub generator software cost? A: Pricing varies widely depending on the features, scalability, and provider. Some offer subscription-based models, while others offer one-time purchases. Compare pricing from different providers to find the best fit for your budget.

- Q: Is it difficult to use paycheck stub generator software? A: Most modern solutions are designed with user-friendliness in mind. Many offer intuitive interfaces and tutorials to ease the learning curve. However, the complexity can vary depending on the features and functionalities offered.

- Q: What are the legal implications of using this type of software? A: Ensure the software complies with all relevant federal, state, and local regulations regarding payroll and data privacy. Consult with legal professionals if you have specific concerns.

Conclusion: Embrace Efficiency with Paycheck Stub Generator Software

Implementing paycheck stub generator software is a strategic investment that significantly improves efficiency, accuracy, and compliance in payroll management. By automating tedious tasks and providing valuable insights, these tools empower businesses to focus on growth and strategic initiatives. Choosing the right software requires careful consideration of your specific needs and budget, but the benefits far outweigh the initial investment.

Resources:

While specific product recommendations are beyond the scope of this general guide, you can research reputable software providers by searching for “paycheck stub generator software” on review sites like Capterra or G2. Consult the IRS website (irs.gov) and your state’s labor department for up-to-date information on payroll tax regulations.

Call to Action:

Ready to streamline your payroll process and boost efficiency? Start exploring paycheck stub generator software options today! Research different providers, compare features, and choose the solution that best fits your business needs. Your time and resources are valuable – invest in a tool that will help you maximize both.

In conclusion, paycheck stub generator software provides a robust solution for efficient and accurate payroll processing. By automating the creation of pay stubs, businesses can significantly reduce administrative burden, minimize errors, and improve overall productivity. The accessibility and user-friendly nature of these programs make them a valuable asset for organizations of all sizes, contributing to a smoother and more efficient payroll management system.

Source: stubcreator.com

The time and cost savings alone justify the adoption of this technology in today’s fast-paced business environment.

Source: softwaresuggest.com

Query Resolution: Paycheck Stub Generator Software

What types of files can these programs typically generate?

Most programs generate PDF and printable formats, often allowing for customization of the stub’s appearance.

Is my data secure with these programs?

Reputable software providers employ robust security measures, including encryption and secure data storage, to protect sensitive payroll information.

What is the cost of paycheck stub generator software?

Pricing varies widely depending on features, the number of employees, and whether it’s a subscription-based or one-time purchase.

Can I integrate this software with my existing accounting software?

Many programs offer integration capabilities with popular accounting software, though compatibility should be verified before purchase.

What level of technical expertise is required to use this software?

Most programs are designed to be user-friendly, requiring minimal technical skills to operate effectively.